Why This Junior Exploration Company Is Raising Money When It Doesn't Need To

The dilution is the price of a calculated swing at a potential multi billion-dollar discovery.

Kintavar Exploration Inc (soon to be renamed Auriginal Metals Corp)

TSX Venture: KTR

Market Cap: ~$15 million CAD

Need to Know in 30 Seconds

Geophysics de-risked the target: Last week’s downhole geophysics results identified multiple moderate to strong conductors exactly where CEO Peter Cashin’s newly interpreted VMS model predicted, confirming drill-ready targets

Raising from strength, not desperation: C$3.5M hard cash remains untouched for G&A and business development while C$5M flow-through fully funds flagship Roger discovery drilling

Defensive Flow-through Funding: Bull market duration is not guaranteed; Having treasury cash (and no debt) means better terms, no full warrants, maintaining leverage

January 2026 discovery drilling: 5,000-5,500m program targeting LaRonde-style VMS at 500-550m depth where historical drilling hit 7.0% Zn, 3.2% Cu, 27 g/t Au, 124 g/t Ag

Existing 535 Koz gold endowment provides value floor: Roger’s historical resource (535,000 oz AuEq from 58,000m drilling) establishes baseline, brownfield asset value before any VMS discovery upside

IAMGOLD’s C$400M camp consolidation drive: Roger sits within IMG’s stated 17km radius for central processing facility serving Nelligan Complex - discovery holes place KTR as strategic blocking position

Cashin’s intimate knowledge: CEO who drilled Roger in 1985 and built underground ramp now applying modern VMS techniques to 58,000m historical database, targeting C$1-2B in situ potential

Kintavar (TSX-V: KTR) announced a C$5 million flow-through financing this morning, and the initial reaction I’m seeing suggests investors don’t understand why a company sitting on C$3.5M cash would dilute.

Allow me to dissect it.

Defensive & Opportunistic Financing

David Lotan, CEO of LHI Capital and one of mining’s sharpest investors, in a recent interview with Resource Talks Antonio Atanasov explained the counterintuitive truth about defensive market financing: “Going into a bear market, companies that have money will be able to raise money because investors will understand that they aren’t broke and they aren’t on their knees. Having a good balance sheet means you’re going to be a preferred issuer when times are tough.”

Kintavar is raising out of a position of strength: Strong balance sheet, no debt and last week’s geophysics confirmed multiple high profile drill targets exactly where Peter Cashin predicted VMS mineralization would sit.

The C$5M flow-through financing ring-fences a fully-funded discovery program at Roger while preserving C$3.5M hard dollars for G&A, marketing, and business development.

Nobody knows how long this bull market lasts. Raising now from a position of strength beats burning your treasury and hoping things work out.

Hard Downhole Geophysics Confirm VMS Potential

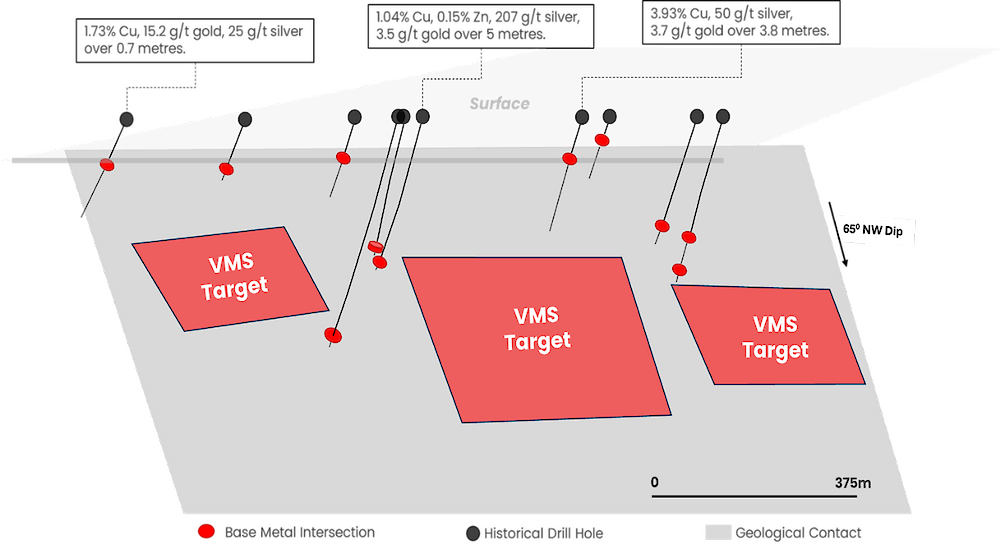

Physical conductors detected by borehole electromagnetics in proven high-grade polymetallic zones.

The November 12th geophysics results systematically validated nine independent lines of evidence supporting Roger as a LaRonde-style VMS system.

Cashin stated: “These EM anomalies appear exactly where our geological model predicts they should be, within the most prospective parts of the system. The strong to moderate conductivity in areas we interpret as hosting the strongest geological similarities to Agnico Eagle’s LaRonde mine gives us confidence that a base metal sulphide deposit could exist on the property.”

The highest-priority target: a very strong 500 siemens off-hole conductive plate aligning with historical drilling that hit 1.73% Cu, 25.0 g/t Ag, 15.2 g/t Au over 0.7m.

Two parallel moderate conductors sit 100m below the deepest drilling in areas where historical holes intersected 7.0% Zn, 0.36% Cu, 10.5 g/t Ag over 6.0m and 3.6% Zn, 3.2% Cu, 124.0 g/t Ag, 27.0 g/t Au over 1.2m.

IAMGOLD Is On The Hunt For Roger-Style Assets

IAMGOLD spent C$400M in October acquiring Northern Superior and Orbec to consolidate the Chibougamau district into what they’re calling the “Nelligan Mining Complex.”

Their press release specifically referenced “a central processing facility being fed from multiple ore sources within a 17-kilometre radius.”

Roger sits squarely within that radius.

If Kintavar’s January 2026 drilling intersects LaRonde-style VMS mineralization, they suddenly hold strategic blocking positions at both Roger (potential polymetallic discovery) and their other asset, Anik (75% owned by IAMGOLD, contiguous with Nelligan’s 8.2 Moz).

One or multiple high-grade polymetallic discovery holes at Roger will catapult KTR’s valuation into a category where today’s flow-through dilution becomes irrelevant noise.

Cash In On Cashin

Peter Cashin drilled Roger in 1985, built the underground exploration ramp, and spent months systematically reinterpreting 58,000 meters of historical drilling using modern VMS techniques unavailable four decades ago.

In recent interviews, he stated the company believes Roger could host up to C$2 billion in situ economic ore based on C$200-250 per tonne rock values observed at comparable regional VMS deposits.

Given his team’s intimate knowledge of the project and expert synthesis of historical data with new geophysics, the probability of a major discovery is high.

Why I Am Accumulating KTR

At 11.5 cents for charity flow-through units and 9 cents for flow-through shares, investors get full Canadian exploration expense deductions plus 24-month warrants at 12 cents.

The company gets C$5M dedicated to testing the highest-conviction VMS targets in Chibougamau while maintaining financial flexibility through preserved hard cash.

This is textbook smart capital allocation: raise when you have leverage, fully fund a high probability discovery program, and maintain optionality for business development as IAMGOLD continues consolidating the district.

The dilution is the price of a calculated swing at a potential billion-dollar discovery.

I’ll take that bet with a CEO who built the underground mine 40 years ago and just proved his reinterpretation with hard geophysics.

IMPORTANT DISCLAIMER AND RISK DISCLOSURE

This analysis is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any securities. The author is not a licensed financial advisor, investment advisor, broker-dealer, or registered investment advisor and does not provide personalized investment advice or recommendations tailored to any individual’s financial situation.

All information presented is the author’s opinion based on publicly available information and should not be relied upon as the sole basis for any investment decision. Readers should conduct their own due diligence, research, and analysis before making any investment decisions and should consult with qualified, licensed financial professionals before investing.

Junior mining and exploration stocks carry substantial risks, including but not limited to: potential total loss of investment, extreme price volatility, liquidity risk, operational risks, regulatory changes, commodity price fluctuations, exploration failures, and dilution from future financings. These investments are speculative in nature and may not be suitable for all investors.

The author may hold positions in securities mentioned and may buy or sell such positions at any time without notice. Past performance does not guarantee future results.

Forward-looking statements and projections are inherently uncertain and subject to numerous risks and uncertainties. Actual results may differ materially from any projections or expectations expressed herein.

This content is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. By reading this analysis, you acknowledge that you understand and accept these risks and limitations.

What are your thoughts on XXIX — which now owns 19.99% of Auriginal? Stephen Stewart — CEO of Orecap and ex-CEO of XXIX believes it’s the most undervalued company in the entire portfolio. With copper potentially breaking out of a multi-year resistance this could be very explosive and alignment is demonstrated by Mr. Stewart’s recent open market purchase of 100,000$ in August 25