The JMP Take: When Everything’s Running, What Actually Deserves Your Capital

The hardest buying decisions come when the whole sector’s on fire

Metals across the board have got legs again.

From gold and silver, to copper and uranium. The REE complex is once again stirring after a late 2025 boom-retreat cycle. Even lithium is starting to break out. Ultra-rare minerals like indium and gallium are starting to trend.

Every metal on the periodic table seems to have a geopolitical premium attached to it now.

Japan’s bond market is doing things that make veterans nervous.

Tariffs and the America-First movement are reshaping supply chains.

Resource nationalism is spreading.

The most hardened investors, those who have been through decades of battle, know the most dangerous time to deploy serious capital is when everything looks like opportunity.

The Internet Guru Problem

Social media’s absolutely buzzing with victory laps right now.

In a wildfire, even wet wood burns.

When panic buying hits a sector, promotion trumps fundamentals for a while.

Bad teams with mediocre projects get bid up alongside quality.

The guru who bought garbage at the bottom looks like a genius at the top.

The gurus cash out and go quiet when their picks crater 80%.

The market’s giving everyone a participation trophy right now. Don’t confuse a bull market with skill.

The FOMO Trap

Buyer’s anxiety is real in moments like this.

Pro tip: Chasing new highs works until it doesn’t.

You’re watching stocks gap up daily. Your watchlist is a sea of green. Every stock you passed on three months ago just doubled.

The fear of missing out becomes paralyzing. So you freeze. Or worse, you chase.

I’m not saying every stock at 52-week highs is overextended. Some have legitimate room to run based on the quality of what they’re building.

But when you’re buying solely because price is moving and you’re afraid of being left behind, you’ve already lost the discipline that compounds capital.

The anxiety comes from thinking you need to own everything that’s working. You don’t.

You need to own the right things before they work.

The Bear Market Sniff Test

Here’s a question that cuts through every bit of promotional noise and market euphoria: Would you buy this company in a bear market?

If the answer’s no, why are you chasing it with everybody else right now, exposing yourself to the volatility shocks that come when momentum inevitably reverses?

I use this filter religiously.

Strip away the rising metal prices, the sector enthusiasm, the promotional momentum.

Look at the company’s fundamentals in isolation: Quality management? Real assets? Funded programs? Technical conviction?

If you wouldn’t touch it when metals were flat and the sector was dead, you’re not investing in value. You’re speculating on continuation of momentum.

Legendary investor Rick Rule has a version of this acid test: Would you buy the entire company at today’s market cap with your own money?

Nothing wrong with speculation if you’re honest about it and size positions accordingly.

But don’t fool yourself into thinking you’ve identified quality when you’re really just riding sentiment.

The companies worth owning in bull markets are the ones you’d be comfortable accumulating in bear markets. Everything else is noise that separates you from capital when the music stops.

What Quality Means

Every promoter talks about “quality assets” and “proven teams.”

Let me get specific about what that means when the whole sector’s heating up.

Management with successful exits. I want teams who’ve built companies and sold them. The junior mining space is littered with career explorers who’ve never delivered a return to shareholders across multiple cycles. In bull markets, these guys raise money easily and burn through it. In bear markets, they dilute you into oblivion. Find the builders who’ve created value and exited before. They know what finish lines look like.

Assets past the greenfield gamble. Early-stage exploration has its place, but in a hot market you can find discovery-stage stories trading at greenfield valuations. Look for companies that have already proven mineralization, identified high-impact targets, and are drilling to expand known systems. You’re cutting out the biggest binary risk while still getting leveraged upside.

Maiden drill programs with geological conviction. There’s a massive valuation gap between companies with targets and companies with holes in the ground. If you can identify a quality team about to drill maiden targets based on solid technical work, you’re positioned before the market reprices the story. The risk drops significantly once initial holes hit, but you’re already in.

Tier-1 jurisdictions trading at tier-2 discounts. Bull markets create weird premiums. Money chases yield into risky jurisdictions while quality projects in safe districts get overlooked. I’m finding opportunities in Quebec, Nevada, Saskatchewan, and select South American districts that should trade at premiums but don’t because retail’s distracted by the flavor of the month.

Stage-of-Development Arbitrage - How I’m Playing It

Different stages of exploration and development trade at wildly different multiples.

In bull markets, these gaps become absurd.

A company with a maiden resource might trade at $50/ounce gold equivalent.

The same geology on the same trend trades at $10/ounce if they haven’t published a resource yet.

But if that second company has the cash to drill and a technical team that knows what they’re doing, that gap closes fast when results hit.

Right now I’m finding the biggest value disconnects in companies about to graduate stages. A recent pick I featured to Premium subscribers rocketed nearly 70% in a month based on this thesis alone.

They’ve de-risked enough to not be pure greenfield gambles, but they haven’t hit the catalyst that triggers the next valuation multiple.

These are my highest conviction positions when I can verify the quality of the technical work and the funding to execute.

Cash Position As Hidden Alpha

This might be the most underappreciated edge in junior mining right now.

Show me the treasury before you show me the targets.

Companies with 12-24 months of cash runway can execute their programs without diluting shareholders.

In a rising market, that means they compound gains. Every drill result, every metallurgical breakthrough, every regulatory approval increases the value of YOUR shares, not a diluted share count.

Unfunded companies are forced to raise money at inopportune times, often at discounts to market with full warrants attached. Your ownership percentage shrinks. The company advances, but you’re running in place.

A great project with six months of cash is a value trap. A good project with one or more years of runway is a compounding machine.

What the Cautious Bulls Are Doing

The internet gurus are pounding the table on everything. The cautious bulls are doing something different.

We’re taking profits on positions that have run. Not selling out completely, but trimming back to free-carry or locking in gains that can redeploy into better opportunities.

Bull markets make you feel stupid for selling anything. Discipline makes you rich when the cycle turns.

We’re rotating out of promoted stories into quiet accumulators. The stocks everyone’s talking about have often run their course with the “easy money” long gone.

The companies making progress without promotional budgets are just starting their moves.

We’re actively deploying into themes that haven’t activated yet.

For instance - Uranium spot price is on the move and entering into a structural bull market. I’m looking at high quality uranium companies that haven’t moved because the market hasn’t connected the dots yet.

The Framework That Actually Works

When everything’s running and you’re trying to decide where to deploy capital, run through this filter.

How long does the cash last? Companies with runway can execute. Companies without runway will dilute you.

Has this story been promoted yet, or are you early? Fresh stories have more upside than exhausted promotions. If you’re hearing about it from three different newsletters, you’re probably late.

What’s the valuation versus comparable companies at the same stage? Enterprise value per pound of metal, per meter of strike length, per ounce equivalent. Find the disconnects within hot sectors.

What’s the next catalyst and when does it happen? Vague timelines mean dilution risk. Specific catalysts with funded programs mean you can position with defined risk/reward.

Is this a tier-1 jurisdiction or am I paying a risk premium? Bull markets make people forget that jurisdiction matters until it really matters.

And most importantly: Would you buy this in a bear market? If not, you’re chasing momentum, not value.

Where I’m Putting Money

I’m not buying the stocks making new highs on hype, “fear of missing out” or promotion. I’m generally attracted to quality teams and assets that haven’t started promoting yet.

I’m looking at companies that went quiet during tax loss season while building world-class partnerships and financing packages.

The market’s distracted by momentum plays. Smart money’s accumulating during temporary dislocations.

I’m finding uranium companies in Saskatchewan’s Athabasca Basin that are assembling district-scale land packages with proven technical teams but trading like greenfield explorers. The geology’s there. The funding’s there. The promotion hasn’t started.

I’m positioned in gold and copper development plays where major mining companies are circling but retail hasn’t made the connection yet. The institutional backing is building quietly. The catalyst timeline is defined. The valuation’s still at exploration multiples while the asset’s already been de-risked.

I’m in lithium stories where the technical work proves the deposit but the stock price hasn’t reflected it because everyone’s chasing the latest promotion in some risky jurisdiction.

Give me tier-1 geology in tier-1 jurisdictions trading at tier-2 valuations every time.

Reality Check

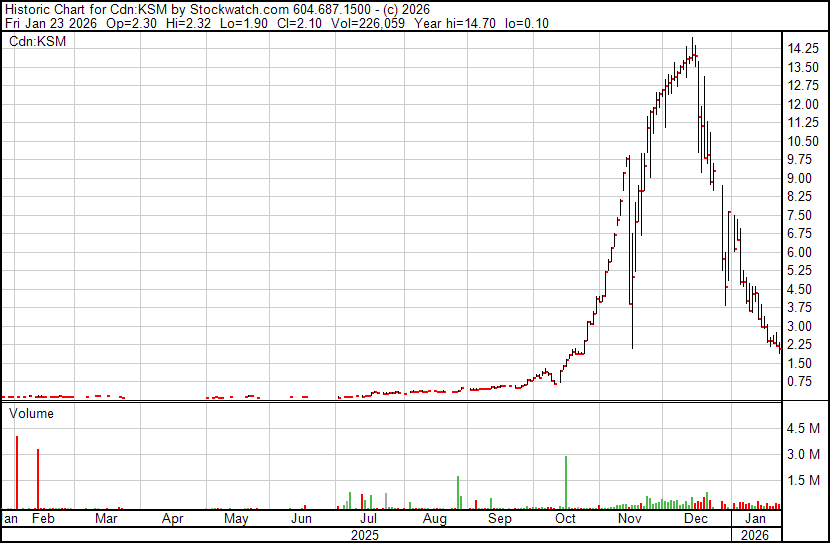

Most of the stocks running right now will give back 60-80% of their gains when this cycle peaks. Over 3 decades of experience and watching the cycles has taught me this rule.

The companies that hold their gains are the ones building real value, not just riding promotional momentum. Quality teams executing quality programs in quality jurisdictions get acquired or developed. Everything else round-trips.

Your job right now isn’t to own “everything” that’s moving. Separate the builders from the promoters while there’s still time to position before valuations fully reflect the opportunity.

The next 6-12 months will separate the investors who made life-changing returns from the speculators who rode the elevator up and back down.

The difference comes down to discipline when everyone else is losing theirs.

IMPORTANT DISCLAIMER AND RISK DISCLOSURE

This analysis is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any securities. The author is not a licensed financial advisor, investment advisor, broker-dealer, or registered investment advisor and does not provide personalized investment advice or recommendations tailored to any individual’s financial situation.

All information presented is the author’s opinion based on publicly available information and should not be relied upon as the sole basis for any investment decision. Readers should conduct their own due diligence, research, and analysis before making any investment decisions and should consult with qualified, licensed financial professionals before investing.

Junior mining and exploration stocks carry substantial risks, including but not limited to: potential total loss of investment, extreme price volatility, liquidity risk, operational risks, regulatory changes, commodity price fluctuations, exploration failures, and dilution from future financings. These investments are speculative in nature and may not be suitable for all investors.

The author may hold positions in securities mentioned and may buy or sell such positions at any time without notice. Past performance does not guarantee future results.

Forward-looking statements and projections are inherently uncertain and subject to numerous risks and uncertainties. Actual results may differ materially from any projections or expectations expressed herein.

This content is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. By reading this analysis, you acknowledge that you understand and accept these risks and limitations.

As always, quality and rational mindset. Thanks JMP for all your tremendous work!

I'm so glad you are here to share your valuable investment wisdom with us. You are the only newsletter I subscribed now after been a collector of subscriptions for 20 years.