Our Portfolio: An Update For Current and New Subscribers, And What's Next

Get caught up quickly on what we are tracking, buying, and why. Also: Premium Chat is Open.

Welcome to all our new subscribers.

We’re thrilled to have you here and look forward to interacting with you as we navigate what promises to be an extraordinary year for the metals sector.

2026 is shaping up to be a pivotal period.

The junior mining sector, with its unmatched torque to commodity prices, offers the greatest upside potential in the entire resource space.

SUBSTACK PREMIUM CHAT IS LIVE

I’ve opened up the Substack Chat channel for Premium subscribers. I will be monitoring it for discussion and Q&A, as well as alert you to stories I’m watching or stocks I am buying. If you want to get ahead of the crowd, this is the best way. I may not always be online, however I will be checking in regularly to chat with our amazing international community.

Cautionary Note On The Metals Bull Market

While I, and many experts in the sector, believe we have entered into a structural natural resources bull market driven by technological advancements, AI, robotics, and geopolitical tensions, where there is a raging bull market, there will be volatility.

My aim is to profile stocks whose downside is protected by a strong asset base, cash, market tailwinds, and skilled management at the helm.

When profit taking inevitably occurs after strong runs, these are typically the best candidates to add to your positions.

All of our stock picks are chosen carefully to be driven by clearly defined upcoming catalysts with the potential for major rerating

We will live with the volatility as long as management presses onward toward their objectives and communicates this progress with shareholders.

Rest assured, we are monitoring our picks closely and will inform readers at any point where there is cause for concern, or conversely, cause for excitement.

You’re in the right place at the right time.

Portfolio Update: What JMP Is Watching And Covering

I understand that in a universe of many picks, it’s a challenge for newcomers to know where my head is at across the board and how I size and rate my positions.

Here’s what I’m currently holding, and tracking (this is available to all subscribers):

Atlas Salt Inc.

TSXV: SALT | OTCQX: REMRF

Transitioning Canada’s largest undeveloped salt project from permits to production

Market cap: ~$93 million CAD

The North American industrial salt shortage is real. Atlas Salt controls the Great Atlantic Salt Project in Newfoundland. A shovel-ready 10 billion tonne resource targeting 2030 first production and an update FS mine-life of 24 years.

With early works approved, Hatch Ltd. signed as lead engineering partner, and recent OTCQX uplisting, the company has de-risked execution significantly. The $350-400M debt financing in the works with Endeavour Financial positions this as a near-term producer in a $36B global market. Management just brought in mine-builder Nolan Peterson as CEO: the same caliber of operator who delivered New Afton, Rainy River, and Hope Bay. Watch for construction commencement and offtake agreements as key catalysts through 2026.

Kirkland Lake Discoveries Corp.

TSXV: KLDC | OTC: KLKLF

40,000-hectare land consolidation in Ontario’s legendary Kirkland Lake gold camp with drills turning

Market cap: ~$40 million CAD

KLDC recently raised an oversubscribed $12.72 million private placement led by mining finance legends Eric Sprott and Rob McEwen, and commenced their fully-funded 25,000m drill program on November 21st.

The company confirmed dual mineralizing systems across their district-scale (40,000 hectares) land package located in the heart of the Kirkland Lake gold camp: a copper-rich massive sulphide (CRMS) system and an intrusion-related gold system (IRGS), significantly enhancing discovery potential in geology that created giants like Horne (53.7Mt), LaRonde (18.9Mt), and Sigma-Lamaque (35.6Mt).

Management strengthened the technical team with VP Exploration Ben Cleland and Technical Adviser Dr. Jean-Francois Montreuil, with a second rig planned for January 2026.

At $40.3M market cap for prime Abitibi real estate with institutional backing and drills turning, this is positioned for significant newsflow through 2026.

American Critical Minerals Corp.

TSXV: KCLI | OTC: [not yet listed]

Triple critical mineral exposure in Utah’s proven Paradox Basin with Q1 2026 drilling

Market cap: ~$19.5 million CAD

America imports over 90% of their potash from Canada.

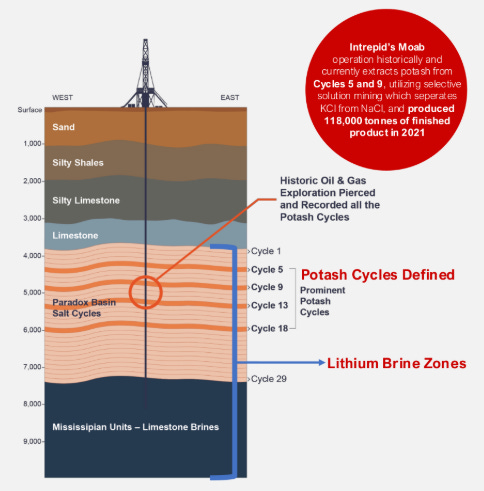

The company targets large scale, high grade potash, lithium AND bromine from the same brine system in Utah’s Paradox Basin, with three drill holes fully permitted and bonded on SITLA leases, plus four authorized holes on BLM leases awaiting final bonding.

KCLI recently raised oversubscribed $7.451 million in institutional-led financings and has a board of directors stacked with veteran talent in developing and managing brine deposits: Dean Pekeski with 33 years mining sector experience including 17+ years potash focus, who led Western Potash’s Milestone project and serves as CEO of Peak Minerals developing Utah’s Sevier Playa SOP project; and Kenneth Taylor, an expert in salt minerals and evaporite deposits; was with Intrepid Potash Inc. for 12 years including as part of senior management, latterly as vice-president of business development.

The upcoming maiden drill program is designed to validate historic data and position for maiden resource estimates and PFS/PEA across all three critical minerals. With Q1 2026 mobilization targeted, this offers early-stage exposure to domestic supply chain independence in a district validated by neighbor Anson Resources’ 1.5M tonne lithium resource (and advanced DLE pilots being funded by South Korean giant POSCO) and Intrepid Potash’s legacy potash mine, 20 miles away, with 50+ years of production.

UraniumX Discovery Corp. (formerly Stearman Resources)

CSE: STMN

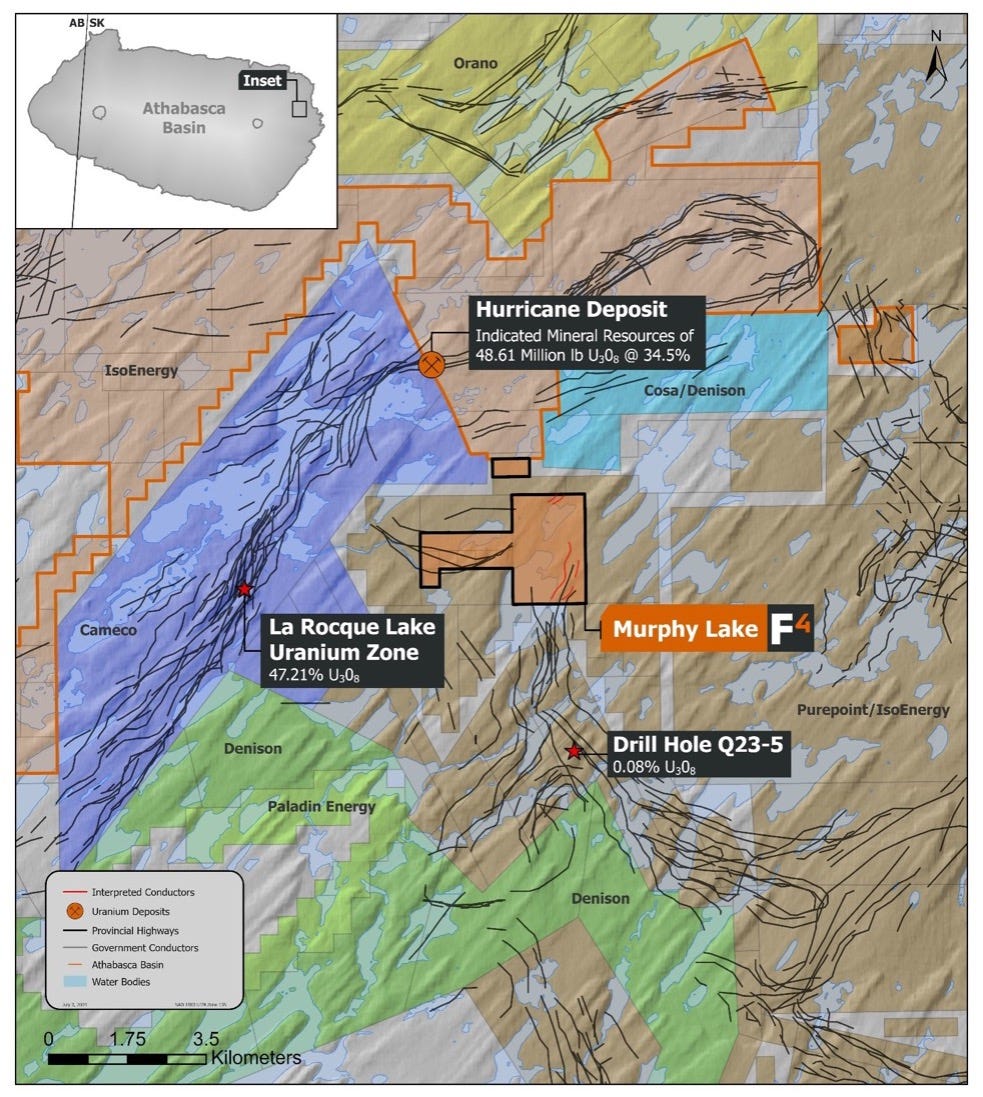

33,000 hectares in the Athabasca Basin with the world’s most accomplished uranium discovery team

Market cap: $15 million CAD

A Uranium Dream Team with a robust treasury and an exceptional asset base.

After recently raising $4.1 million, UraniumX has just announced another $1.5 million private placement due to institutional demand, positioning the company with robust war chest to commence ambitious exploration campaigns focused on drilling Murphy Lake this Spring.

Murphy Lake sits just 3km from IsoEnergy’s world-class Hurricane discovery - the highest grade uranium discovery in the world; 15km north of the Nova discovery, and 4km east of Cameco’s La Rocque Lake.

The board is stacked with technical talent - unrivalled in the Athabasca Basin : Ken Wheatley (Exploration Director, 8 Athabasca discoveries including McArthur River and Cigar Lake), Dr. Yuanming Pan (Technical Advisor, leading academic authority on Athabasca unconformity systems), Matthew Schwab (Director, Arrow discovery team, Roughrider sale for $654M), and Vincent Martin (Strategic Advisor, former Orano Canada CEO with 37 years global uranium operations).

At $0.22/share after 45 days of consolidation with this caliber of team directing systematic expansion drilling across 33,000 hectares, and a robust cash position, this represents my highest conviction uranium play heading into Spring 2026 catalysts.

Formation Metals Inc.

TSXV: FOMO | OTCQB: FOMTF

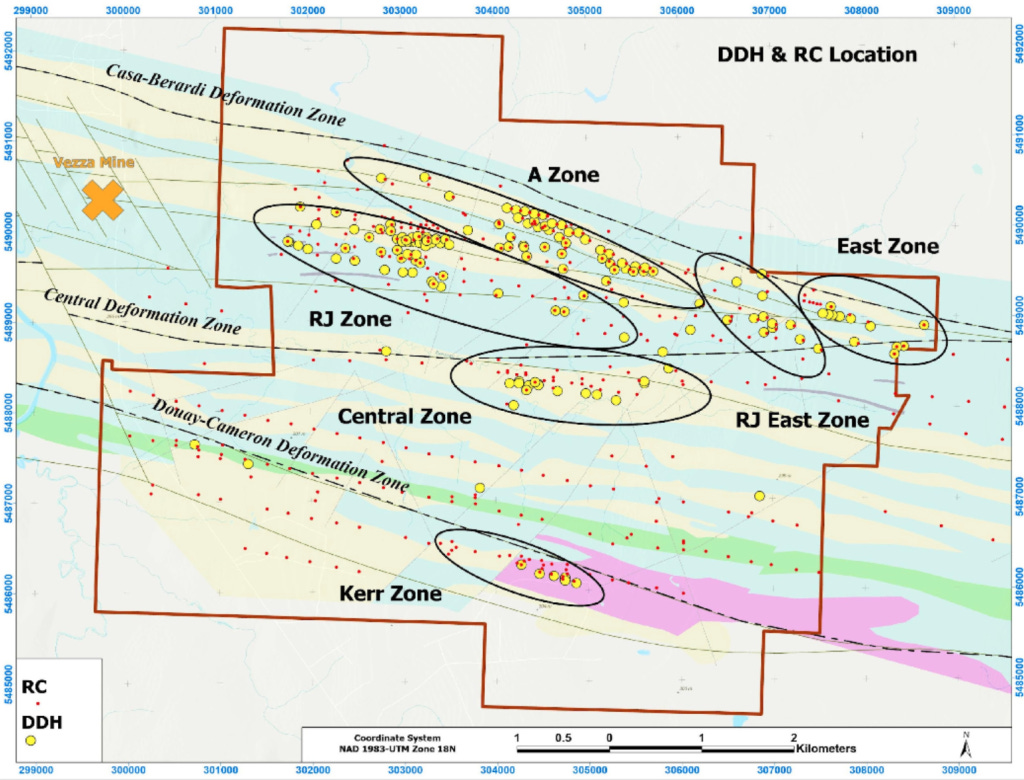

30,000m drill program expanding 871,000 oz historical resource in the Abitibi

Market cap: $38 million CAD

Shares of FOMO took a hit with the rest of the gold market on Friday, however the thesis remains stronger than every.

FOMO acquired a 4,400-hectare Abitibi gold project with an 871,000 oz historical resource during the 2024 bear market.

With gold recently skyrocketing past $5,000, the entire story must be re-rated as every ounce in the ground - historical, and those to yet be discovered, are now exponentially more valuable than when the company picked up the asset.

Historic work (over 50,000M of drilling) has already outlined ~871,000 oz (non-43-101) across the A, East, RJ‑East and Central zones plus the high‑grade RJ zone, yet only about 35% of the A Zone strike has ever been drilled, leaving more than 3.1 km of fully permitted ground in front of the rigs.

The company just announced their maiden NI 43-101 resource estimate following Phase 1 completion. With exceptional near-surface hit rates (10 of 13 holes) and six standout holes showing 100+ meter intervals, they are now running TWO drill rigs to accelerate the discovery timeline.

With $12.3M in treasury, zero debt, and a fully-funded 30,000m program designed to triple the resource base, management is executing a clear path to modern compliance and potential major producer takeover. In the strongest gold bull market in history, this remains one of 2026’s most mispriced growth plays.

Auriginal Mining Corp. (formerly Kintavar Exploration)

TSXV: AUME

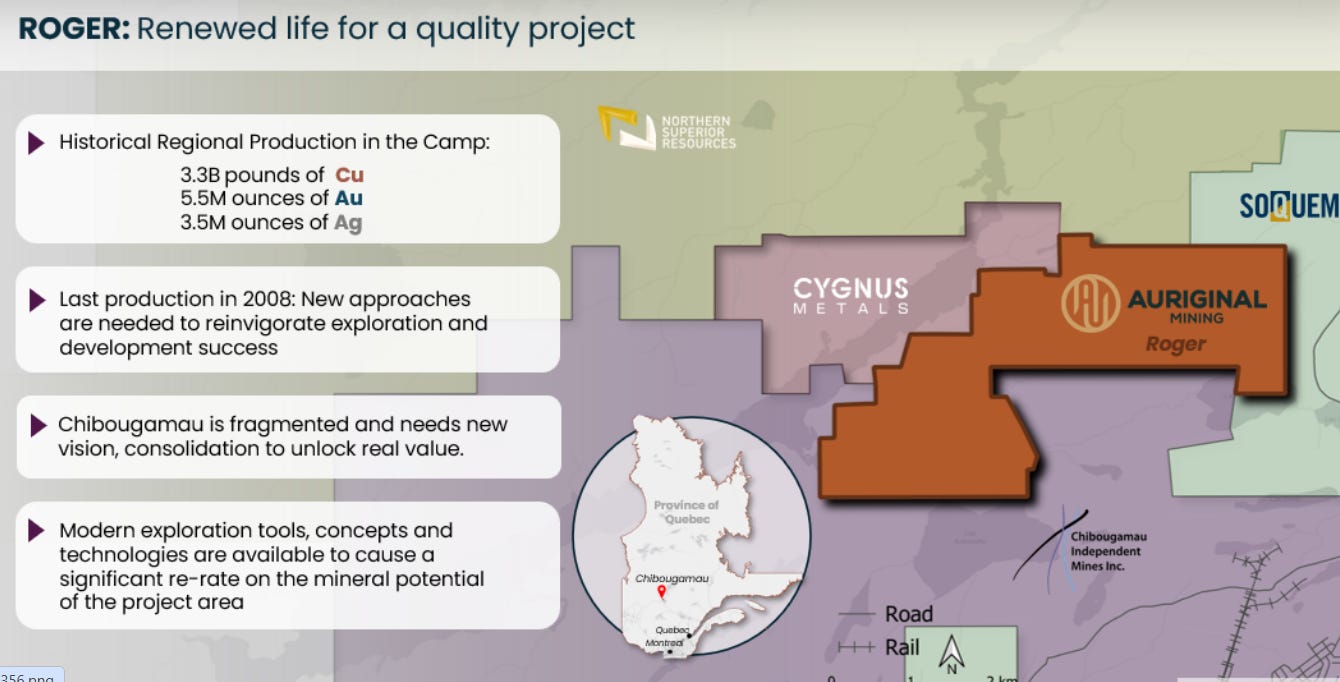

Reinterpreting 58,000m of historic drilling with modern VMS techniques in Quebec’s Chibougamau district

Market cap: ~$21.1 million

Following the take over of Auriginal Mining by the Ore Group and veteran mining and exploration operator Stephen Stewart, the rebranding from Kintavar to Auriginal Mining signalled a fundamental shift in this story.

CEO Peter Cashin originally drilled AUME’s flagship Roger project in 1985 and built the underground ramp. Now he’s returned, 40 years later, with modern VMS (volcanogenic massive sulfide) techniques to unlock what 1980s operators missed.

Peter recently stated in an interview the company believes, based on regional rock value, they could be sitting on up to $2 billion of in situ value. Recent downhole geophysics identified 500 siemens conductors plus graphite mineralization confirming VMS stratigraphy rather than the porphyry model previous operators chased. The company is reinterpreting 58,000 meters of historical drilling that includes intersections of 7.0% zinc, 3.2% copper, 27 g/t gold, and 124 g/t silver.

Located in Quebec’s Chibougamau district with geological analogies to Agnico Eagle’s LaRonde mine, Roger sits along a 1.8km strike length with targets positioned 100-300m below previously drilled high-grade zones.

With C$8.5M in the treasury funding an ongoing January-February 2026 drill program designed to test the VMS model at depth, backed by Stephen Stewart’s Ore Group, Cashin’s intimate project knowledge creates a compelling rediscovery opportunity the market is currently pricing around C$0.08.

Kicker: The company just announced the commencement of diamond drilling at its other asset - the Anik joint venture with gold giant Iamgold, to test new high-priority gold targets. The Anik property in immediately adjacent to the northern boundary of Iamgold’s prolific Nelligan gold project, 40 kilometres southwest of Chapais, Que.

A Note About Premium Tier

These are the publicly available stock picks I’m tracking. To access content and picks exclusive to paid members, upgrade for only $8/month (or $88/year).

Backed by 34 years of personal investment experience in the sector, you are receiving the best value by far. These rates are subject to an increase in the future (current members keep their rates forever!).

What’s Coming for Junior Mining Pro

I’m open to feedback on format and what you’d like to see on the Substack.

We’re working hard to add sections where you can track what I currently own, why, and what my exit plan is, along with many more features to help with your own investment decisions, including an end-of-week summary of the most interesting stories in the sector.

We are literally building this plane as it’s taking off - your feedback is invaluable.

I launched this newsletter as a passion project to share my decades of knowledge with a new community and spread the news that the junior mining sector is thriving; and to show “outsiders” that this sector is an excellent destination for your capital, especially with someone with my experience guiding you.

It’s grown beyond my expectations and I’m excited about growing together and providing best in class research, positioning your portfolio to outperform in any market condition.

Stay tuned!

IMPORTANT DISCLAIMER AND RISK DISCLOSURE

This analysis is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any securities. The author is not a licensed financial advisor, investment advisor, broker-dealer, or registered investment advisor and does not provide personalized investment advice or recommendations tailored to any individual’s financial situation.

All information presented is the author’s opinion based on publicly available information and should not be relied upon as the sole basis for any investment decision. Readers should conduct their own due diligence, research, and analysis before making any investment decisions and should consult with qualified, licensed financial professionals before investing.

Junior mining and exploration stocks carry substantial risks, including but not limited to: potential total loss of investment, extreme price volatility, liquidity risk, operational risks, regulatory changes, commodity price fluctuations, exploration failures, and dilution from future financings. These investments are speculative in nature and may not be suitable for all investors.

The author may hold positions in securities mentioned and may buy or sell such positions at any time without notice. Past performance does not guarantee future results.

Forward-looking statements and projections are inherently uncertain and subject to numerous risks and uncertainties. Actual results may differ materially from any projections or expectations expressed herein.

This content is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. By reading this analysis, you acknowledge that you understand and accept these risks and limitations.

What is your portfolio percentage into each of these stocks?

Thank you for the updates. Those who value your work will stay along for the ride.