The Ultimate Uranium Junior Setup: Dream Team, 3 Shots at Discovery, Cashed Up And Ready To Go

Renowned Geological Discovery Team, 3km from World's Highest-Grade Uranium Discovery, Fully Funded, Under The Radar: The Perfect Storm for Exponential Gains

Stearman Resources (CSE: STMN) - Three, Two, One...

(U.S. Investors: Trade Canadian-listed stocks through Interactive Brokers)

For investors new to the uranium sector, it’s critical to understand the Athabasca Basin in Saskatchewan is the Saudi Arabia of high-grade uranium.

This isn’t my first uranium cycle. I’ve watched companies in this district go from under $10 million market caps to 10x buyouts when the drill bit confirms what the geology suggests.

The difference with STMN is they’ve quietly assembled all the pieces while flying completely under the radar.

STMN announced on Friday December 12th the closing of it’s $4.1 million financing, setting the company up for what I’ve been waiting for - a Q1-2026 high impact uranium discovery drive.

The technical dream team is assembled. And the uranium bull market is just getting started.

Market Cap: ~$8.8M CAD presents a ground floor entry for investors seeking high-torque, short-term exponential capital gains potential

CEO Lester Esteban stated: “With completion of this final tranche, not only are we fully funded for our Murphy Lake spring drill program, but the additional capital supports disciplined advancement of our exploration programs at both Zoo Bay and Neocore in the new year.”

What’s all the excitement about?

Readers who have been with us since September are familiar with my enthusiasm over Stearman Resources and the supercharged portfolio of assets/team they’ve quietly assembled over the summer.

Our readers have been accumulating stock in anticipation of what just happened: the financing has closed, and they are ready to deploy, led by one of the highest profile discovery teams I’ve encountered in Saskatchewan’s world-class Athabasca Basin.

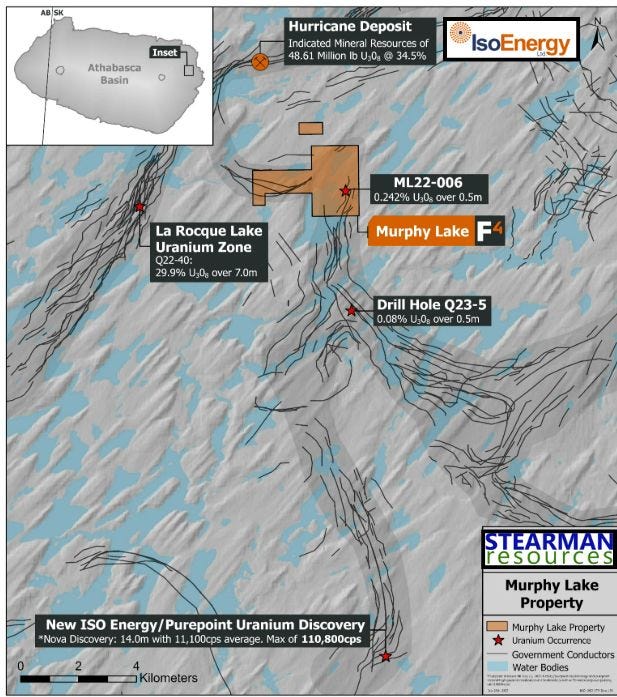

The newsletter has primarily been focused on STMN’s flagship asset: Murphy Lake, located a short ~3km from IsoEnergy’s (TSX: ISO) world-class Hurricane discovery in the Athabasca Basin.

Hurricane is a high-grade uranium discovery featuring massive mineralization (48.61M lbs U₃O₈ at 34.5% Indicated, plus Inferred, making it one of the highest-grade uranium resources globally,) showing potential for significant expansion, and considered a key asset for IsoEnergy.

STEARMAN RESOURCES (CSE: STMN)

Financing Complete, Boots on the Ground Imminent

On December 12th, STMN announced the final closing of its strategic financing, raising a total of $4.1 million ($2.12M flow-through + $1.98M hard dollar).

The company is now fully funded with both hard dollars for G&A (business development and marketing) and, critically, $2.12 million in flow-through funds earmarked strictly for exploration, drilling and development of an asset base which is sure to light up screens in the coming months.

This deal has been fine-tuned to near perfection in terms of share structure, hard/flow-through capital raise, project quality, management and a technical team unrivalled in the Basin.

Board Strengthened with Resource Development Veteran

Concurrent with the final financing close, STMN appointed Tyler Thorburn to the board of directors.

Thorburn brings extensive experience in resource exploration, development and extraction projects since 2008, having coordinated land acquisitions, environmental permitting and aboriginal consultations for major operators including Enbridge, Williams Energy, Canadian Natural Resources and Trans-Northern Pipelines.

He currently serves as President and CEO of TSX-V listed Total Metals Corp.

The addition of Thorburn further strengthens an already purpose-built team featuring:

Ken Wheatley (Exploration Director) - 8 Athabasca discoveries, 4 into production including McArthur River and Cigar Lake

Dr. Yuanming Pan (Technical Advisor) - Leading academic authority on Athabasca unconformity systems

Matthew Schwab (Director) - Arrow discovery team, Roughrider sale to Rio Tinto for $654M

This is an all-star Athabasca Basin uranium discovery technical team, now armed with capital and ready to kick into high gear.

Multiple Shots at Discovery Glory

As if Murphy Lake wasn’t enough to convince me into an aggressive share buying regimen, STMN has two additional loaded barrels aimed at district-scale discoveries:

Zoo Bay (19,850 Ha) - The Sleeper Giant

🔸 Straddles Athabasca Basin’s erosional edge where major discoveries cluster

🔸 3.2km uranium-thorium enriched corridor

🔸 80km from McLean Lake mill (processing advantage)

NeoCore (13,012 hectares) - Blue-Sky Play

🔸 Sits in Wollaston Domain basement which hosts Key Lake and Cigar Lake operations

🔸 Five+ anomalies identified from 2021 airborne surveys

🔸 Four uranium system types targeted

The Setup Is Complete - It’s Go Time

33,000 total hectares in the world’s premier uranium district.

🔸 One discovery rerates the entire portfolio

🔸 Three chances to hit paydirt during the biggest uranium bull market setup in decades

IMPORTANT DISCLAIMER AND RISK DISCLOSURE

This analysis is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any securities. The author is not a licensed financial advisor, investment advisor, broker-dealer, or registered investment advisor and does not provide personalized investment advice or recommendations tailored to any individual’s financial situation.

All information presented is the author’s opinion based on publicly available information and should not be relied upon as the sole basis for any investment decision. Readers should conduct their own due diligence, research, and analysis before making any investment decisions and should consult with qualified, licensed financial professionals before investing.

Junior mining and exploration stocks carry substantial risks, including but not limited to: potential total loss of investment, extreme price volatility, liquidity risk, operational risks, regulatory changes, commodity price fluctuations, exploration failures, and dilution from future financings. These investments are speculative in nature and may not be suitable for all investors.

The author may hold positions in securities mentioned and may buy or sell such positions at any time without notice. Past performance does not guarantee future results.

Forward-looking statements and projections are inherently uncertain and subject to numerous risks and uncertainties. Actual results may differ materially from any projections or expectations expressed herein.

This content is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. By reading this analysis, you acknowledge that you understand and accept these risks and limitations.