Manitoba: The Secret Portfolio Hack Gold and Lithium Investors Should Know About

By the end of this article you will be an expert in Manitoba's fertile geology and the players exploiting it. Impress your friends!

Most gold and base metals investors focus on Canada’s big three mining districts: B.C.’s Golden Triangle, Ontario’s Red Lake, and the Abitibi belt - each of which deserve a comprehensive piece on their own (we’ll save those for another day.)

However those attract the lion’s share of attention, promotion, and valuation, pulling investor eyeballs away from outliers like Manitoba.

Yet Manitoba’s mineral belts quietly stack multi‑million‑ounce endowments, fully built mills, and lithium‑rich pegmatites.

The publicly traded companies operating there do so largely under the mainstream radar.

That disconnect, grounded in facts and data rather than hype, is where real arbitrage may lie.

Why You Should Care About Manitoba At All

Manitoba checks a lot of boxes:

Proven belts: Rice Lake and Lynn Lake are documented as the province’s most productive lode‑gold districts, with multi‑million‑ounce endowment when you combine past production and current resources.

Infrastructure: towns, roads, hydro power, and a long mining history mean fewer “frontier” risks than many of the more popular, less developed gold stories around the world (Yukon, Alaska, many South American and African jurisdictions, Golden Triangle).

Under‑followed tickers: most Manitoba‑centric names sit in the small‑/mid‑cap bucket, far below big‑ETF radars, even when they control full mines and mills.

By the end of this article, you’ll know which Manitoba belts matter, which stocks actually give you exposure, and how to assemble them into a quiet hedge on higher gold (with a small kicker from lithium and cesium).

The Rice Lake Belt: Manitoba’s Hidden “Red Lake”

If Manitoba has a flagship gold belt, Rice Lake is it.

The Rice Lake–Bissett camp has historically produced the majority of Manitoba’s primary gold. The Rice Lake/San Antonio/True North mine complex alone accounts for most of that output, with other smaller mines scattered along strike.

The geology is classic Archean greenstone: old volcanic rocks folded, sheared, and cut by stacked quartz veins.

In simple terms, the crust cracked, hot fluids moved through, and gold got left behind, over and over again.

A fully built, fully permitted mine and mill still sits in the middle of this belt: the True North complex.

1911 Gold (TSXV: AUMB, OTCQX: AUMBF) owns it, along with a ~62,000‑hectare land package in the Rice Lake belt.

1911 Gold market capitalization: $293 million CAD

1911’s current resource:

499,000 oz indicated and 644,000 oz inferred at underground grades, based on a 2025 NI 43‑101 report.

A targeted 2027 restart, with a PEA underway and active underground and surface drilling.

Milling capacity is already there.

ONGold (TSXV: ONAU) controls two district-scale land packages in NE Manitoba: Monument Bay with significant gold and tungsten mineralization over a 40 km strike length; and Domain, 19.836 hectares, hosting approximately 833,000 tonnes at 4.5 g/t Au (historic, non-compliant), totaling about 120,000 ounces of gold, with large leases unexplored and wide open for exploration.

Every satellite ounce found at Monument Bay, Domain, or other Rice Lake‑style structures has a theoretical path to a central plant.

Key takeaway: Rice Lake gives you something rare in junior gold: a “broken‑in” district with a big, permitted mill in the center and multiple under‑followed explorers around it.

Lynn Lake & Last Hope: A Camp Being Rebuilt in Real Time

Lynn Lake is a classic “mining town 2.0” story.

It was historically a nickel and gold camp. Operations shut. People moved away. Then Alamos Gold (TSX/NYSE: AGI) stepped in with a modern plan.

Alamos’ Lynn Lake project is anchored by the MacLellan and Gordon deposits in northern Manitoba.

It’s backed by a 2023 feasibility study outlining more than 3 Moz of open‑pit reserves and a decade‑plus mine life at competitive AISC, giving the company a new long‑life gold engine in Canada.

Now add torque.

55 North Mining (CSE: FFF) owns Last Hope, a high‑grade gold project roughly 20 km from the planned Lynn Lake mill.

55 North Mining market capitalization: ~$20 million

A technical report outlines ~344 koz at grades in the mid‑5 g/t range - that’s roughly four times Lynn Lake’s open‑pit grade.

If Alamos builds Lynn Lake, high‑grade satellites like Last Hope become natural toll‑milling candidates.

In a strong gold market, that dynamic can turn a micro‑cap like FFF into a leveraged bet on Alamos’ capex spend and any exploration success.

Key takeaway: AGI is your anchor. FFF is the small, volatile option that can snap higher if (when) Lynn Lake gets built and high‑grade feed becomes strategic.

Flin Flon–Snow Lake–Sherridon: Copper‑Gold VMS With Embedded Upside

The VMS deposits in this district have a habit of carrying meaningful gold.

Quick explainer: VMS (volcanic‑hosted massive sulphide) deposits formed around ancient undersea vents. Hot, metal‑rich fluids vented into seawater, cooled, and dropped copper, zinc, gold, and silver into mounds of sulphide. Multiple mounds formed along the same horizons, which is why you see deposit clusters.

The current lineup:

Hudbay Minerals (TSX/NYSE: HBM): operates the Lalor mine in Snow Lake, a copper‑zinc operation with strong gold by‑product credits and a long record of replacing reserves.

Visionary Copper & Gold Mines (TSXV: VCG): owns Pine Bay, a multi‑deposit VMS camp 16 km from Flin Flon, with high‑grade copper‑zinc‑gold discoveries (Rainbow and Descendent) along a 10‑km trend.

T2 Metals (TSXV: TWO): drilling the Sherridon VMS project in a historic mining district within the same regional belt.

QMC Quantum Minerals (TSXV: QMC): mixes Rocky Lake and Namew Lake VMS projects with the historic Irgon lithium resource, giving both copper/zinc and battery‑metal exposure.

Key takeaway: Gold credits that can improve mine economics more than headline copper grades suggest. Additional torque if copper and zinc tighten, because these are polymetallic systems. Use HBM as core exposure; layer VCG, TWO, and QMC as higher‑risk, higher‑reward satellite bets on new VMS discoveries with gold upside.

Border‑Belt High Grade: Total Metals as a Gold Price Lever

At the Manitoba–Ontario border, the Archean greenstone continues (because geology cannot see political red lines).

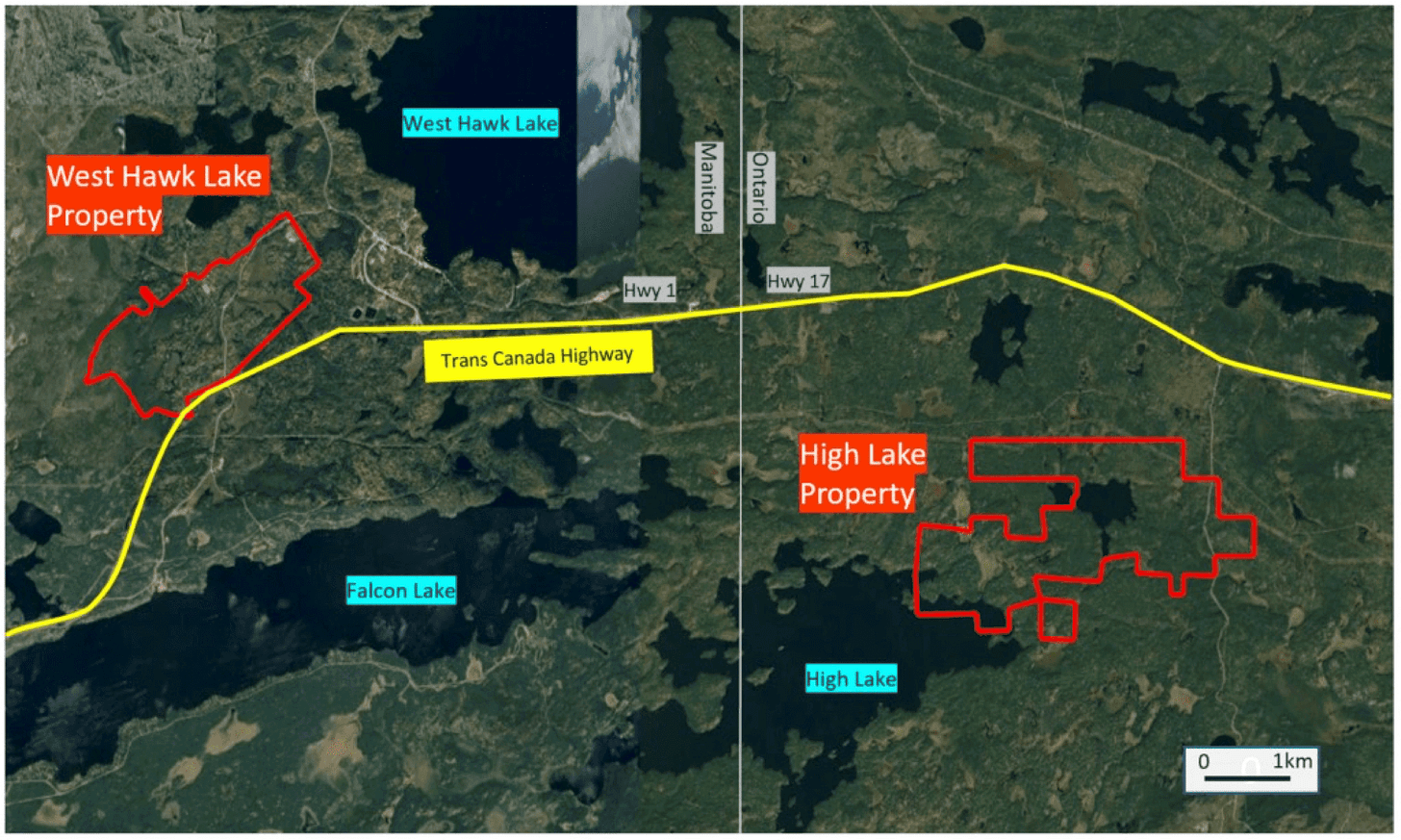

Total Metals (TSXV: TT) owns High Lake and West Hawk Lake, two gold projects that straddle this border along the Trans‑Canada Highway. The rocks and structural setting line up with southeastern Manitoba’s greenstone trend.

Total Metals market capitalization: $43 million CAD

From the current resource:

High Lake shows a combined indicated + inferred resource around 457,000 tonnes at almost 14 g/t Au across multiple zones, with standouts like the Sundog target above 30 g/t.

West Hawk Lake has a 1983 historical resource that is not NI 43‑101 compliant but demonstrates additional high‑grade potential.

Why I find this interesting in a portfolio context:

High grades mean economics are highly sensitive to the gold price. At US$1800, it might be marginal; at US$2400, it may look very different. At US$4000+, senior operators and miners bat an eyebrow and take interest.

As a micro‑cap explorer‑developer with roadside access and very high grades, TT is essentially a call option on both the drill bit and the gold price curve.

Key takeaway: If you want one “swing for the fences” name in this universe that gives you max leverage to a rising gold price, Total Metals is the candidate.

Lithium and Cesium: The Sidecar Trade

You came for gold. You might stay for the battery metals.

Two Manitoba names that stand out right now:

Snow Lake Energy (Nasdaq: LITM)

Controls the Snow Lake Lithium project in northern Manitoba, where spodumene‑bearing pegmatites already have a defined resource and more drilling underway.

Now owns 100% of the Shatford Lake project in the Bird River belt after Surface Metals sold its remaining 49% interest in 37 claims back to Snow Lake in late 2025.

Grid Metals (TSXV: GRDM)

Advancing the Falcon West cesium project, which has returned very high cesium grades over multi‑metre intervals.

Owns Makwa, a nickel‑copper‑PGE project with a C$17.3M earn‑in agreement from Teck, giving it a major‑company partner in the corridor.

Both operate within well‑established structural corridors: Snow Lake in the Snow Lake region and Bird River pegmatite belt; Grid along the Thompson‑Snow Lake critical‑minerals trend.

Key takeaway: LITM and GRDM are not your core holdings here, but small positions can add EV‑metal optionality without blowing up the risk profile of a gold‑heavy basket.

Why This Opportunity Exists (And Hasn’t Been Arbed Away)

If the geology and infrastructure are this good, why is Manitoba still cheap?

A few reasons:

Narrative. Investors know Red Lake and the Abitibi. Everybody knows about the Golden Triangle in BC. Manitoba’s belts are smaller, and many were marketed for base metals first, so they never built the same story equity, and are not broadly covered.

“Mature camp” bias. Rice Lake and Flin Flon are often written off as “picked over.” But modern geophysics and deeper drilling have already delivered new high‑grade zones under and beside historic workings at places like True North and Pine Bay.

Market‑cap filter. 1911 Gold, 55 North, Total Metals, QMC, and several others are too small for big indices and many institutional mandates. That leaves price discovery mostly to retail, family offices, and specialist funds.

Actionable Insight

Let’s get practical. Here’s one way to use all of this (this is not investment advice, rather, how I would personally approach the Manitoba strategy - refer to the disclaimer below):

1. Pick your anchors

These are the names you size meaningfully and hold through cycles:

AGI – for Lynn Lake and diversified production.

HBM – for Lalor and VMS gold credit plus copper/zinc.

AUMB – for Rice Lake/True North restart torque wrapped around a built plant.

2. Add district‑level torque

Layer smaller positions in:

FFF and ONAU for Lynn Lake and Rice Lake satellite ounces.

VCG, TWO, and QMC for VMS discoveries with gold by‑products around Flin Flon and Sherridon.

3. The high‑torque flyer

TT as the high‑grade, micro‑cap lever to a stronger gold market and exploration success.

4. Decide if you want the battery‑metal kicker

LITM and GRDM as small sidecar positions tied to lithium and cesium in the Snow Lake and Thompson/Bird River corridors.

Size everything according to your risk tolerance.

The idea is not to bet the farm on one junior, but to build a basket that quietly compounds if Manitoba’s belts move from “ignored” to “discovered” in the wider market.

If you track gold and mining but don’t yet track Manitoba, this is your reminder: the rocks are already proven. The stories just haven’t gone mainstream, yet.

IMPORTANT DISCLAIMER AND RISK DISCLOSURE

This analysis is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or a recommendation to buy, sell, or hold any securities. The author is not a licensed financial advisor, investment advisor, broker-dealer, or registered investment advisor and does not provide personalized investment advice or recommendations tailored to any individual’s financial situation.

All information presented is the author’s opinion based on publicly available information and should not be relied upon as the sole basis for any investment decision. Readers should conduct their own due diligence, research, and analysis before making any investment decisions and should consult with qualified, licensed financial professionals before investing.

Junior mining and exploration stocks carry substantial risks, including but not limited to: potential total loss of investment, extreme price volatility, liquidity risk, operational risks, regulatory changes, commodity price fluctuations, exploration failures, and dilution from future financings. These investments are speculative in nature and may not be suitable for all investors.

The author may hold positions in securities mentioned and may buy or sell such positions at any time without notice. Past performance does not guarantee future results.

Forward-looking statements and projections are inherently uncertain and subject to numerous risks and uncertainties. Actual results may differ materially from any projections or expectations expressed herein.

This content is not intended for distribution to, or use by, any person in any jurisdiction where such distribution or use would be contrary to local law or regulation. By reading this analysis, you acknowledge that you understand and accept these risks and limitations.

Absolutely amazing article!

HBM is a new one for me. Thank you!😊

Positioned in the other two AGI and 1911