Basel III has changed the Gold game. The macroeconomic implications for gold investors are profound.

Effective July 1, 2025, B3 positions gold as a premier Tier 1 high-quality liquid asset (HQLA), fundamentally reshaping its role in the global financial system and creating a bullish macro environment

Basel III has changed the game folks.

The macroeconomic implications are profound. Get your gold junior miner picks ready, and strap in.

Effective July 1, 2025, B3 positions gold as a premier Tier 1 high-quality liquid asset (HQLA), fundamentally reshaping its role in the global financial system and creating a bullish macro environment for the metal.

Under these rules, U.S. banks can now value physical gold at 100% of its market price for core capital reserves, a significant upgrade from its prior Tier 3 status with a 50% valuation discount.

This regulatory shift reduces the risk weighting of gold to 0%, as outlined by the World Gold Council, incentivizing banks to hold physical gold over paper assets to meet stringent liquidity requirements like the Net Stable Funding Ratio (NSFR).

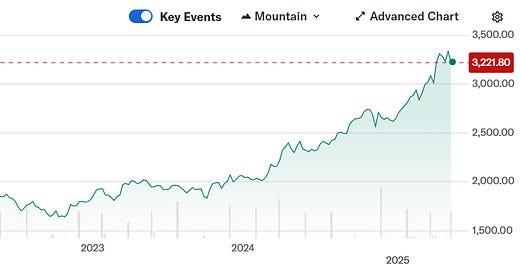

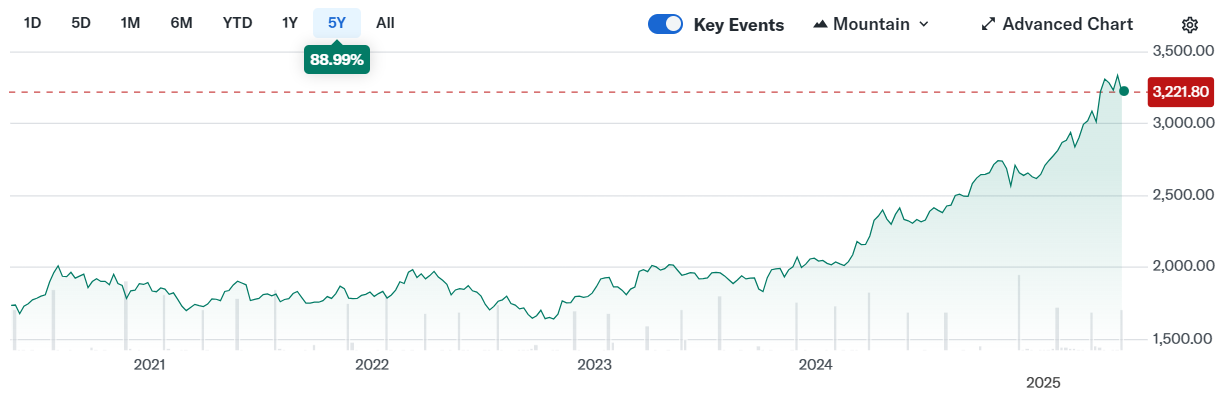

As banks and central banks (already holders of 20% of global gold reserves) increase their physical gold holdings, demand is likely to surge, driving prices higher.

This trend is already evident, with central banks in China, India, and Poland boosting reserves in response to Basel III.

Moreover, Basel III’s elevation of gold to a Tier 1 asset challenges the dominance of the U.S. dollar as the world’s reserve currency, as it reduces reliance on dollar-denominated debt and fiat-backed assets.

This shift could accelerate de-dollarization trends, further enhancing gold’s appeal as a safe-haven asset amid global economic uncertainty.

For investors, this creates a compelling opportunity in gold and gold-related equities, particularly junior mining companies, which are poised to benefit from a trickle-down effect as demand for physical gold rises.

Despite short-term price fluctuation, the long-term outlook for gold remains robust, supported by structural demand and its reaffirmed status as a financial system stabilizer under Basel III.

https://www.mining.com/web/basel-iii-makes-it-official-gold-is-money-again/

Very true, and a good read - cheers